| RISK AND SAFETY COMMITTEE | 3 Meetings in 2022 |

| | |

RISK AND SAFETY COMMITTEE | 7 Meetings in 2020 |

CHAIR

Bailey

Ford | MEMBERS

Allerton

Ford

Halvorsen

Bailey

Matlock | Although the NYSE listing standards do not require a standing risk and safety committee or that any such committee be comprised exclusively of independent members, all members of the Risk and Safety Committee qualify as independent under the applicable NYSE listing standards, SEC rules and the Board’s independent assessment. |

| | | | |

| |

p | ROLES AND RESPONSIBILITIES |

The Risk and Safety Committee:

| 1. | based on reports provided by the Company’s management, monitors (A)(i) the adequacy of material fire, health, safety, security, business continuity, cyber security, chain of custody and information security and risk management strategies and systems for the reporting of accidents, incidents and risks, and (B)(ii) material investigations and remedial actions, as appropriate; |

| 2. | |

2. | reviews the Company’s establishment and operation of its enterprise-wide risk management (“ERM”), program which is designed to identify, assess, monitor and manage risk throughout the Company, and includes an annual management ERM report to the Board; |

| 3. | |

3. | monitors the Company’s insurance program; |

| 4. | |

4. | furnishes periodic reports to the Board concerning the Risk and Safety Committee’s work; and |

| 5. | |

5. | examines any other matters referred to it by the Board. |

| |

20212022 PROXY STATEMENT | 2321 |

Table of Contents

CORPORATE GOVERNANCE MATTERS

TECHNOLOGY COMMITTEE | Committee established October 2020; 0 Meetings in 2020 |

CHAIR

Halvorsen | MEMBERS

Allerton

Deninger*

Ford

Matlock | Although the NYSE listing standards do not require a standing technology committee or that any such committee be comprised exclusively of independent members, all members of the Technology Committee qualify as independent under the applicable NYSE listing standards, SEC rules and the Board’s independent assessment. |

| | |

| |

| |

* | not standing for re-election |

| |

p | ROLES AND RESPONSIBILITIES |

The Technology Committee:

1. | reviews the technology strategy of the Company in light of the Company’s global business and evolving customer needs and focus; |

| |

2. | recommends pathways to innovation to achieve the Company’s technology strategy; |

| |

3. | monitors significant new or emerging technologies for the Company’s products or platforms, be informed of associated investments and understand the connection to the Company’s technology strategy; |

| |

4. | reviews the external environment, including (A) overall industry trends, (B) competitors of the Company’s product offerings and (C) platforms and potential risks resulting from new or competing technologies; |

| |

5. | recommends to the Board topics for its continuing education on existing and emerging technologies and suggests regular Board updates on the Company’s technology strategy, including products and technology platforms; and |

| |

6. | examines any other matters referred to it by the Board. |

| |

24 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

THE BOARD’S ROLE, RESPONSIBILITIES AND POLICIES

THE BOARD’S ROLE IN RISK OVERSIGHT

Our senior management, with oversight from the Board, is responsible for the Company’s risk management process and the day-to-day supervision and mitigation of enterprise risks. We have a comprehensive enterpriseERM which is designed to identify, assess, monitor and manage risk management program, includingthroughout the receipt by our senior executive team of regular reports from our operations teams and standing committees ofCompany, with the Board that focus on enterpriseexercising oversight responsibility for risk emerging trendsboth directly and issues.through standing committees. |

OUR BOARD OF DIRECTORS The Board reviews and discusses with management significant risks affecting the Company, including matters escalated by its committees within their respective areas of oversight. The Board also formally reviews the Company’s overall risk position and risk management processes at least annually, which allows the Board and each committeeof its committees to remain coordinated in overseeing enterprise risk. In addition,Further, our independent Chair ensures that important topics, including those relating to risk matters, are included as topics for discussion by the Board. Although management, including our CEO, and the Board and its committees work together on risk matters, the Board has the ultimate oversight authority. The Board also reviews the Company’s ethics and compliance program annually. The Board reserves the right to and periodically does consult with outside advisors and experts from time to time to assist the Board in anticipating future threats and trends. OUR BOARD COMMITTEES The Nominating and Governance Committee composed of each committee chair, annuallyperiodically reviews the allocation of risk oversight among the Board’s committees. TheEach committee focuses on specific aspects of enterprise risk, emerging risk trends and ad-hoc risk issues in the areas of risk allocated to it. In coordination with the Board, the Nominating and Governance Committee also periodically reviews environmental, social and social governance (“ESG”ESG“) strategy and initiatives, including such issues as climate change.initiatives. The Risk and Safety Committee reviews and monitors fire, health, safety, security, business continuity, cybersecurity, chain of custody and information security and risk management strategies, systems and policies and processes implemented, established and reported on by management. The Risk and Safety Committee also has the primary responsibility for assisting the Board with oversight of the Company’s ERM program, which is designed to identify, assess, monitor and manage risk throughout the Company, and includes an annual management ERM report to the Board. BOARD COMMITTEE CHAIRSThe Audit Committee oversees, among other things, (i) the integrity of the Company’s financial statements and financial reporting process, (ii) the performance of the Company’s internal audit function and independent auditors, and (iii) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters. The Audit Committee also assists the Board in overseeing the Company’s compliance with legal and regulatory requirements.

The Compensation Committee oversees the executive compensation program throughout the year with the assistance of an independent compensation consultant and also reviews and discusses the risks arising from the Company’s compensation policies and practices. During each regularly scheduled Board meeting, each committee chair provides a summary to the Board of his or her committee’s risk discussions since the most recent regularly scheduled Board meeting. The Risk and Safety Committee provides additional support to the Board to ensure (i) that the Company’s enterprise risk management program includes the enterprise risk management framework, (ii) that the Company’s governance structures are appropriate and operating effectively and (iii) sufficient expertise and continuity between the Board’s periodic reviews of the Company’s enterprise risk. The key responsibilities of each standing committee of the Risk and Safety CommitteeBoard and the risk oversight of othersuch committees are further detailed on page 23.pages 18 through 21.

IRON MOUNTAIN EXECUTIVEOUR MANAGEMENT TEAM

Our management team, with oversight from the Board, is responsible for the Company’s risk management process and the day-to-day supervision and mitigation of enterprise risks. Our ERM program includes the receipt by our executive team of regular reports from our operations personnel. Our executive team has established an enterprise risk committee which includes each of our executive vice presidents and is chaired by our Chief Risk Officer. The enterprise risk committee oversees our risk and compliance activities, ensuring that management has appropriate policies, structures and systems in place for managing risks of the business. We also maintain an enterprise risk steering committee and regional risk committees which review risk trends and emerging risks to our business and report risk topics to our enterprise risk committee. Through their participation in our enterprise risk committee, our executive team reviews and prioritizes significant risks, allocates resources for mitigation and provides the Board with regular reports on areas of potential Company risk, including strategic, operational, information security, human resources, financial, legal, compliance, REIT and regulatory risks. |

| |

| |

| 22 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

Each of the Board’s standing committees has been assigned the oversight of certain identified risks, and the Board, or the committee of the Board assigned responsibility for a specific area of risk, receives updates from the Company executive accountable for understanding and mitigating each such identified risk. The Company’s Chief Risk Officer, who reports to the Chief Operating Officer, is responsible for the day-to-day oversight of the risk management program. The Chief Risk Officer provides an ERM report at each meeting of the Risk and Safety Committee. The ERM report addresses short-term and long-term enterprise risks, risk trends and noteworthy incidents. The Company’s Chief Compliance Officer, who reports to the General Counsel, is responsible for the development, review, and execution of the Company’s compliance and business conduct program and, with the General Counsel, regularly reports to the Board and the Audit Committee. The Company also consults with outside advisors as necessary to identify and understand emerging risks. ASSESSING COMPENSATION RISK

OUR INTERNAL AUDIT TEAM The Compensationinternal audit team, under the direct supervision of the Audit Committee, reviewsidentifies and helps mitigate risk, and assesses and improves the executive compensation program throughoutCompany’s internal controls. The internal audit team accesses the yearCompany’s disclosure controls and procedures and reports any material weaknesses or significant deficiencies to the Audit Committee. At each meeting of the Audit Committee, the Vice President of Internal Audit and the Chief Compliance Officer meet with the assistance of an independent compensation consultant. For a more detailed discussion on this topic, please see the “Compensation Discussion and Analysis” section of this Proxy Statement.Audit Committee in closed session.

|

| |

2021 | |

| 2022 PROXY STATEMENT | 2523 |

Table of Contents

CORPORATE GOVERNANCE MATTERS

THE BOARD’S ROLE IN MANAGEMENT SUCCESSION

The Board oversees the recruitment, development, and retention of executive talent. Management succession is generally discussed throughout the year with the CEO at Board meetings and in executive sessions. Management succession discussions generally focus on the CEO and other senior executive roles and also include broader discussions about the Company’s workforce. The Board has regular and direct exposure to senior leadership and high-potential employees through meetings held throughout each year.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

The Board believes it is important to engage effectively with stockholders and has adoptedmaintains a written Stockholder Engagement and Communication Policy (the “Stockholder Engagement Policy”), which outlines the procedures for the Board’s engagement and communication with the Company’s stockholders. The Stockholder Engagement Policy is overseen by the Nominating and Governance Committee. Under the Stockholder Engagement Policy, any stockholder, security holder or other interested party who desires to communicate with the Board, any individual director, including the Chairman,Chair, or the independent or non-management directors as a group, may do so by regular mail or email directed to the Secretary of the Company. Communications to the Board should be mailed to Corporate Secretary, Iron Mountain Incorporated, One Federal Street, Boston, Massachusetts 02110; the Secretary’s email address is corporatesecretary@ironmountain.com. Upon receiving such mail or email, the Secretary will assess the appropriate director or directors to receive the message and will forward the mail or email to such director or directors without editing or altering it.

CORPORATE GOVERNANCE GUIDELINES

The Board has adoptedmaintains our Corporate Governance Guidelines that describe our corporate governance practices and policies and provide a framework for our Board governance. The topics addressed in our Corporate Governance Guidelines include: composition and selection of the Board; director responsibilities; Board meetings; Board committees; director access to management and independent advisors; director compensation; executive compensation clawback; director orientation and continuing education; management evaluation and succession; the Board’s annual performance evaluation and conflicts of interest. Our Corporate Governance Guidelines are available on our website, www.ironmountain.com, under the heading “Investors/Corporate Governance.Governance/Governance Documents.”

INSIDER TRADING ANTI-HEDGING AND ANTI-PLEDGING POLICY

Our Insider Trading Policy, as adopted by our Board, provides our directors and employees with guidelines for when transacting the Company’s securities is appropriate. The Insider Trading Policy prohibits directors and all employees from engaging in short-term or speculative transactions involving the Company’s securities, such as short sales, optionoptions trading, short-termshot-term trading, standing or limit orders, and hedging transactions. The Insider Trading Policy also prohibitshedging. In addition, directors and executives with a title of senior vice president or above are prohibited from placing the Company’s securities in margin accounts or otherwise pledging shares of Common Stock. AllAlso, directors and certain employees are required to receive approval from our general counsel’s office before transacting the Company’s securities or establishing contracts, instructions, or plans intended to satisfy the conditions of Rule 10b5-1(c) under the Exchange Act. As of March 30, 2023, all executive officers and directors are in compliance with our Insider Trading Policy.

EXECUTIVE COMPENSATION CLAWBACK POLICY

Our Board has adopted Corporate Governance Guidelines, including an executive compensation clawback policy. The Company’s clawback policy permits recoupment of performance-based or incentive compensation if an executive officer has engaged in fraudulent or other intentional misconduct and the misconduct resulted in a material inaccuracy in the Company’s financial statements or performance metrics that affect such executive officer’s compensation. The Board may seek recoupment of the portion of the executive’s performance-based or incentive compensation paid or awarded to the executive that is greater than would have been paid or awarded if calculated based on the accurate financial statements or performance metrics.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Board has adopted a Related Person Transaction Policies and Procedures (the “Related Persons Policy”), which provides that all transactions with related persons are subject to approval or ratification by our Audit Committee. With certain exceptions, the Related Persons Policy provides that the Audit Committee shall review the material facts of all transactions with related persons and either approve or disapprove of the transaction. Under the Related Persons Policy, covered transactions include all transactions involving (i) the Company, (ii) amounts in excess of $120,000 and (iii) a Related Person (a term that includes executive officers, directors, nominees for election as directors, beneficial owners of 5% or more of the Company’s outstanding Common Stock and immediate family members of

| |

| |

| 24 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

the foregoing). The Audit Committee will determine, among other considerations, (i) whether the terms of a covered transaction are fair to the Company and no less favorable to the Company than would be generally available absent the relationship with the counterparty, (ii) whether there are business reasons for the transaction, (iii) whether the transaction impairs the independence of an outside director, (iv) whether the transaction would represent an improper conflict of interest and (v) whether the transaction is material. In the event that prior approval of a covered transaction is not feasible, the Related Persons Policy provides that a transaction may be approved by

26 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

the chair of the Audit Committee in accordance with such policy. The chair shall report any such approvals at the next Audit Committee meeting. If the Company becomes aware of a transaction with a Related Person that has not been approved by the Audit Committee prior to its consummation, the Audit Committee shall review such transaction and evaluate all possible options, including ratification, revision or termination of such transaction and shall take such action as it deems appropriate under the circumstances. The Related Persons Policy is intended to supplement, and not supersede, our other policies and procedures with respect to transactions with Related Persons. ThereDuring the year ended December 31, 2022, there were no new transactions with related persons that required the review of our Audit Committee in 2020.Committee.

THE COMPANY’S POLICY AND BOARD OVERSIGHT OF POLITICAL EXPENDITURES

Our Global Political Contribution Policy, adopted by our Nominating and Governance Committee, and together with our Code of Ethics and Business Conduct, guide our approach to ethical business behavior and corporate political contributions. Our Global Political Contribution Policy provides that Iron Mountain does not make political contributions in any form or amount from corporate funds or resources, even when permitted by applicable law. Iron Mountain does not use corporate funds in support of or opposition to political candidates, political parties, political committees and other political entities organized and operating for political candidates or for “electioneering” communications.

The Company administers IMPAC, which is a non-partisan political action committee supporting congressional candidates at the federal level only. IMPAC is governed by a set of bylaws and supervised by a board of directors composed of senior managers from different areas of the Company. IMPAC allows eligible employees to pool their resources to support candidates who understand the issues important to the Company’s business and its employees. Participation in IMPAC is strictly voluntary. Except for administrative expenses, IMPAC is funded solely by the Company’s employees and directors and is not supported by funds from the Company. IMPAC complies with federal election laws and all other applicable laws and reports regularly to the Federal Election Commission.

The Company is a member of a number of trade associations that participate in public relations activities such as education and conferences, but not for the purpose of making political contributions. Our Code of Ethics and Business Conduct and our Global Political Contribution Policy are available on our website under the heading “Investors/Corporate Governance.Governance/Governance Documents.”

Our Nominating and Governance Committee annually reviews contributions by the IMPAC, determines the IMPAC board members and reviews the Company’s Political Contribution Policy and the Company’s compliance therewith.

DIRECTOR STOCK OWNERSHIP GUIDELINES

We maintain director stock ownership guidelines that require non-employee directors to achieve and maintain ownership of our Common Stock at or above a prescribed level. Our directors who are also employees of the Company are subject to the Company’s executive stock ownership guidelines described on page 5249 of this Proxy Statement. We established these guidelines to help align long-term interests of directors with stockholders. The guidelines require each director to own and retain Common Stock, exclusive of unexercised stock options and performance shares or performance units (“PUs”), having a value equal to fivesix times the director’s annual cash retainer earned for serving on the Board.

As of April 1, 2021,March 30, 2023, all of the Company’s non-employee directors are in compliance with the director stock ownership guidelines.

Each director subject to the Company’s stock ownership guidelines is required to retain an amount equal to 50% of the net shares received as a result of the settlement or vesting of restricted stock, restricted stock units (“RSUs”), PUs or the exercise of stock options until such director meets the minimum ownership threshold. “Net shares” are those shares that remain after shares are sold or netted to pay any applicable taxes or purchase price. Because directors must retain a percentage of shares resulting from the vesting of RSUs until they achieve the minimum share ownership threshold, there is no minimum time period required to comply initially with the guidelines.

| |

2021 | |

| 2022 PROXY STATEMENT | 2725 |

Table of Contents

CORPORATE GOVERNANCE MATTERS

DIRECTOR COMPENSATION

20202022 DIRECTOR COMPENSATION PLAN AND DIRECTOR DEFERRED COMPENSATION PLAN

Directors who are employees of the Company do not receive additional compensation for serving on the Board. Pursuant to the 20202022 Company’s Compensation Plan for Non-Employee Directors, non-employee directors received an annual retainer of $80,000 in 2020,2022, and committee members and committee chairs received annual retainer fees as set forth below:

| | | AUDIT

COMMITTEE | | COMPENSATION

COMMITTEE | | NOMINATING

AND

GOVERNANCE

COMMITTEE | | FINANCE

COMMITTEE | | RISK AND

SAFETY

COMMITTEE | | TECHNOLOGY

COMMITTEE(1) |

| Annual Committee Member Retainer | | $ | 15,000 | | $ | 15,000 | | $ | 15,000 | | $ | 15,000 | | $ | 15,000 | | $ | 15,000 |

| Annual Committee Chair Retainer | | $ | 20,000 | | $ | 20,000 | | $ | 20,000 | | $ | 20,000 | | $ | 20,000 | | $ | 20,000 |

| (1) | The Technology Committee was dissolved in May 2022 and its responsibilities were returned to the Board. |

| | | AUDIT

COMMITTEE | | | COMPENSATION

COMMITTEE | | | NOMINATING

AND

GOVERNANCE

COMMITTEE | | | FINANCE

COMMITTEE | | | RISK AND

SAFETY

COMMITTEE | | | TECHNOLOGY

COMMITTEE | |

| Annual Committee Member Retainer | | $ | 13,500 | | | $ | 12,500 | | | $ | 10,000 | | | $ | 10,000 | | | $ | 10,000 | | | $ | 10,000 | |

| Annual Committee Chair Retainer | | $ | 15,000 | | | $ | 15,000 | | | $ | 12,000 | | | $ | 12,000 | | | $ | 12,000 | | | $ | 12,000 | |

Any non-employee director who served on the Board or a committee for less than the entire year received a pro rated retainer based on the dates such non-employee director served on the Board or the applicable committee. In addition, in 2020 the Chairman receivedour Chair receives a retainer of $125,000 and effective October 1, 2020, we modified our non-employee director compensation plan to add compensation for directors who serve on our newly-formed Technology Committee.$150,000.

Non-employee directors received annual grants of RSUs for the number of shares of our Common Stock equal to $160,000$170,000 divided by the Fair Market Value (as defined in the 2014 Plan) on May 13, 2020,10, 2022, the date of our 20202022 Annual Meeting of Stockholders. Non-employee directors who joined the Board after the 2020 Annual Meeting of Stockholders received a pro rated grant as of the date of their appointment to the Board. The RSUs vested immediately on the date of grant.

The Director Deferred Compensation Plan (the “DDCP”), allows non-employee directors to defer the receipt of between 5% and 100% of their cash retainers, in which case participating non-employee directors receive shares of phantom stock in an amount equal to the amount of the cash retainer deferred divided by the fair market value of one share of Common Stock as of the crediting date. Non-employee directors may also defer some or all of their annual RSU grant under the DDCP and receive a number of shares of phantom stock equal to the amount of the annual RSU grant. Dividends, if any, accrued on such phantom stock are deemed to be similarly deferred and credited to the participating non-employee director’s account. The shares of phantom stock are payable in shares of Common Stock on various dates selected by each participating non-employee director or as otherwise provided in the DDCP. Deferral elections and elections relating to the timing and form of payments are made prior to the period in which the retainers, fees and awards are earned. The Company does not contribute any matching, profit sharing or other funds to the DDCP for any participating director. Amounts under the DDCP are treated as invested in shares of our Common Stock. The DDCP is administered by the Chair of the Compensation Committee and the executive vice president primarily responsible for oversight and administration of our compensation programs.

28 |  |

| 26 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

20202022 DIRECTOR COMPENSATION

The following table provides certain information concerning compensation earned by non-employee directors during the year ended December 31, 2020.2022.

| NAME | | FEES EARNED

OR PAID

IN CASH

($)(1) | | | STOCK

AWARDS

($)(2) | | | ALL OTHER

COMPENSATION

($) | | | TOTAL

($) | |

| Jennifer Allerton | | $ | 106,000 | | | $ | 159,991 | | | $ | — | | | $ | 265,991 | |

| Ted R. Antenucci | | $ | 51,860 | | | $ | — | | | $ | 84,111 | (3) | | $ | 135,971 | |

| Pamela M. Arway | | $ | 117,500 | | | $ | 159,991 | | | $ | — | | | $ | 277,491 | |

| Clarke H. Bailey | | $ | 120,567 | | | $ | 159,991 | | | $ | 139,246 | (4) | | $ | 419,804 | |

| Kent P. Dauten | | $ | 125,500 | | | $ | 159,991 | | | $ | — | | | $ | 285,491 | |

| Paul F. Deninger | | $ | 105,000 | | | $ | 159,991 | | | $ | — | | | $ | 264,991 | |

| Monte Ford | | $ | 105,000 | | | $ | 159,991 | | | $ | — | | | $ | 264,991 | |

| Per-Kristian Halvorsen | | $ | 108,000 | (5) | | $ | 159,991 | | | $ | 89,532 | (4) | | $ | 357,523 | |

| Robin Matlock | | $ | 106,346 | | | $ | 159,991 | | | $ | 3,422 | (4) | | $ | 269,759 | |

| Wendy J. Murdock | | $ | 104,817 | | | $ | 159,991 | | | $ | — | | | $ | 264,808 | |

| Walter Rakowich | | $ | 128,500 | | | $ | 159,991 | | | $ | — | | | $ | 288,491 | |

| Doyle Simons | | $ | 102,500 | | | $ | 159,991 | | | $ | 16,039 | (4) | | $ | 278,530 | |

| Alfred J. Verrecchia | | $ | 227,000 | | | $ | 159,991 | | | $ | 125,197 | (4) | | $ | 512,188 | |

| NAME | | FEES EARNED

OR PAID

IN CASH

($)(1) | | | STOCK

AWARDS

($)(2) | | | ALL OTHER

COMPENSATION

($) | | | TOTAL

($) | |

| Jennifer Allerton | | $ | 117,500 | | | $ | 169,950 | | | $ | – | | | $ | 287,450 | |

| Pamela M. Arway | | $ | 142,253 | | | $ | 169,950 | | | $ | – | | | $ | 312,203 | |

| Clarke H. Bailey | | $ | 137,880 | | | $ | 169,950 | | | $ | 185,148 | (3) | | $ | 492,978 | |

| Kent P. Dauten | | $ | 135,000 | | | $ | 169,950 | | | $ | – | | | $ | 304,950 | |

| Monte Ford | | $ | 127,500 | | | $ | 169,950 | | | $ | – | | | $ | 297,450 | |

| Robin L. Matlock | | $ | 117,500 | | | $ | 169,950 | | | $ | 8,581 | (3) | | $ | 296,031 | |

| Wendy J. Murdock | | $ | 123,750 | | | $ | 169,950 | | | $ | – | | | $ | 293,700 | |

| Walter C. Rakowich | | $ | 145,000 | | | $ | 169,950 | | | $ | – | | | $ | 314,950 | |

| Doyle R. Simons | | $ | 120,000 | | | $ | 169,950 | | | $ | 62,458 | (3) | | $ | 352,408 | |

| Alfred J. Verrecchia | | $ | 265,000 | | | $ | 169,950 | | | $ | 171,183 | (3) | | $ | 606,133 | |

| (1) | Ms. Matlock and Mr. Simons elected to defer 100% of theirhis cash retainer fees to the DDCP. |

| (2) | The amounts reported in the “Stock Awards” column reflect the aggregate grant date fair value of RSUs granted in 20202022 computed in accordance with Financial Accounting Standards Board Accounting Standards Codification 718 (“FASB ASC Topic 718”). Assumptions used in the calculation of these amounts are included in Note 2 to the Company’s Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.2022. Each non-employee director was granted 7,0113,300 RSUs on May 13, 2020.10, 2022. Messrs. Bailey, Simons and Verrecchia elected to defer 100% of their RSUs granted in 20202022 pursuant to the DDCP. |

| (3) | Mr. Antenucci was a director until May 2020. The amount reported in the “All Other Compensation” column for Mr. Antenucci consists of dividend equivalents paid on phantom stock pursuant to the DDCP. |

(4) | The amounts reported in the “All Other Compensation” column for Messrs. Bailey, Halvorsen, Simons and Verrecchia and Ms. Matlock consist of dividend equivalents paid on phantom stock pursuant to the DDCP. |

(5) | Includes $25,625 that was earned in 2020 but paid in 2021. |

MODIFICATIONS TO DIRECTOR COMPENSATION FOR 20212023

The Compensation Committee annually reviews, with assistance from our independent compensation consultants, the compensation of our non-employee directors in comparison to companies with similar revenues and business and makes adjustments it believes are appropriate.

Based on this review, the Compensation Committee did not recommend any change to the compensation of our non-employee directors for 2023.

| |

20212022 PROXY STATEMENT | 2927 |

Table of Contents

CORPORATE GOVERNANCE MATTERS

OTHER CORPORATE GOVERNANCE MATTERS

CODE OF ETHICS

Our Code of Ethics and Business Conduct applies to each of the Company’s employees, including officers and directors. Our Code of Ethics and Business Conduct is posted on our website, www.ironmountain.com, under the heading “Investors/Corporate Governance.Governance/ Governance Documents.” A printed copy of our Code of Ethics and Business Conduct is also available free of charge to any stockholder who requests a copy. We intend to disclose any amendment to, or waiver from, a provision of our Code of Ethics and Business Conduct applicable to our CEO, chief financial officer or principal accounting officer or controller by posting such information on our website. Any waivers applicable to any other executive officers will also be promptly disclosed to stockholders on our website.

SUSTAINABILITY

CORPORATE SOCIAL RESPONSIBILITYOUR APPROACH

ENVIRONMENTAL, SOCIAL AND GOVERNANCE OVERVIEW

Iron Mountain is committed to living by our values and putting them into action every day and in everything we do – from safeguarding our customers’ information to empowering employees, serving our communities, and protecting the environment. Our ESG principles are integrated across the business and we strive to be our customers’ most trusted partner for protecting and unlocking the value of what matters most to them in innovative and socially responsible ways.

We conduct periodic materiality assessments, which serve to prioritize ESG topics through engagement with internal and external stakeholders. This process helps to manage ESG risks and identify the topics that are most relevant to the success of our company. While our priority issues evolve, we remain focused on three core elements:areas that will not only protect and elevate the power of our customers’ work, but enable a lasting, positive impact on people, planet and performance.

We are committed to transparent reporting on our ESG initiatives and other sustainability efforts, and we publish an annual report in accordance with the guidelines set out by the Task Force for Climate Related Financial Disclosures and the Global Reporting Initiative Standards. A copy of our corporate responsibility report is available on the “About Us” section of our website, www.ironmountain.com, under the heading “Sustainability”.

OUR PLANET

We are committed to reducing our impact on the environment while driving value to our customers, investors and the communities in which we operate.

| ▲ | We are committed to reducing our greenhouse gas (GHG)(“GHG”) emissions per the recommendations of leading climate institutions, such as the Science Based Targets Initiative, (SBTi).and are signatories of the Climate Pledge to reach net zero emissions by 2040. Additionally, we remain committed to sourcing all of our global electricity use from renewable energy resources in accordance with the standards adopted by the RE100.RE100 by 2040. |

| ▲ | We formalized several products and services to help customers achieve their environmental goals. Customers can meet their GHG goals with Green Power Pass Data Centers, contain e-wasterepurpose electronic waste with Secure IT Asset Remarketing and Recycling services and reduce plastic waste with Sterilization Wrap Recycling.Secure Plastic Disposition services. |

OUR PEOPLE

Attracting, developing, and empowering individuals with a wide range of experiences, capabilities, and points of view is aare key componentcomponents of our success.

| ▲ | Our global Inclusion and Diversity strategy ensures we have the best talent to deliver our business objectives, enable an innovative, high-performance culture and deliver superior performance to our customers and shareholders.stockholders. |

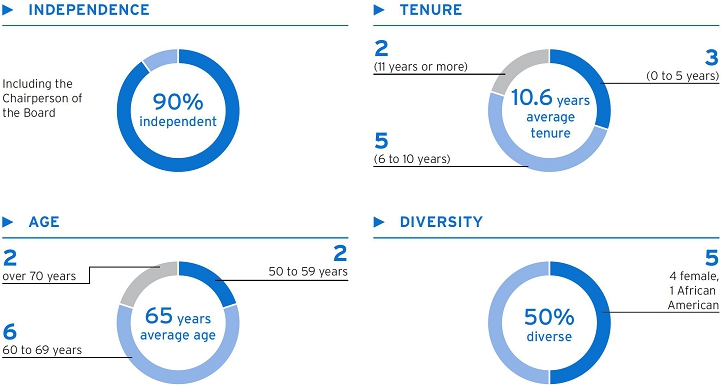

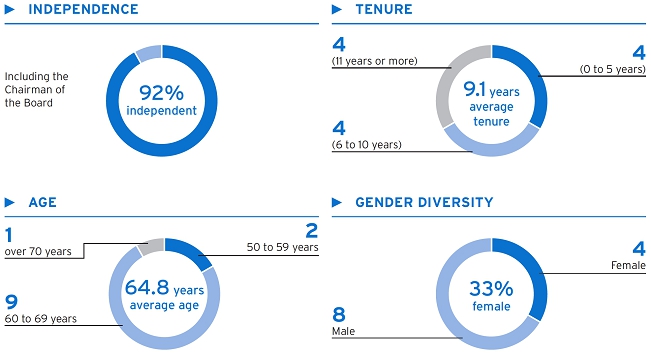

| ▲ | This commitment starts with our Board of Directors; 33%40% of our director nominees are women and 8%10% are from minorityhistorically underrepresented groups. |

OUR COMMUNITIES

We engage with our local communities and support charitable causes.

| ▲ | We offer philanthropic support to our global community through our Living Legacy Initiative, which is our commitment to help preserve and make accessible cultural and historical information and artifacts. |

| ▲ | We encourage our employees to volunteer and offer paid time off to partake in community and civic service.service through our Moving Mountains program. |

The Nominating and Governance Committee receives periodic reports of ESG strategy and initiatives. Iron Mountain is committed to transparent reporting on sustainability and corporate responsibility efforts. We publish an annual corporate responsibility report in accordance with the Global Reporting Initiative Standards. A copy of our corporate responsibility report is available on the “About Us” section of our website, www.ironmountain.com, under the heading “Corporate Social Responsibility”.

30 |  |

| |

| 28 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERSEXECUTIVE COMPENSATION

PROPOSAL

2 APPROVAL OF AN AMENDMENT TO THE 2014 PLANThe Board recommends that you vote FOR the approval of an amendment to the 2014 Plan to increase the number of shares of Common Stock authorized for issuance by 8,000,000, from 12,750,000 to 20,750,000, to extend the termination date of the 2014 Plan from May 24, 2027 to May 12, 2031, to provide that, other than in certain circumstances, no equity-based award will vest before the first anniversary of the date of grant and to provide that dividends and dividend equivalents are not paid with respect to stock options or stock appreciation rights.

|

The Board has unanimously approved, and unanimously recommends that the stockholders of the Company approve, an amendment, attached hereto as Appendix A (the “Amendment”), to the 2014 Plan to increase the number of shares of Common Stock authorized for issuance under the 2014 Plan by 8,000,000 from 12,750,000 to 20,750,000, to extend the termination date of the 2014 Plan from May 24, 2027 to May 12, 2031, to provide that, other than in certain circumstances described in the Amendment and later in this Proposal 2, no equity-based award shall vest, in whole or in part, before the first anniversary of the date of grant or, in the case of vesting based upon the attainment of performance goals or other performance-based objectives, the first anniversary of the commencement of the period over which performance is evaluated, and to provide that dividends and dividend equivalents shall not be paid with respect to a stock option or stock appreciation right.

The Board believes that equity interests are a significant factor in the Company’s ability to attract, retain and motivate key employees, directors and other service providers (generally, and in connection with acquisitions) that are critical to the Company’s long-term success and that an increase in the number of shares available for issuance under the 2014 Plan is necessary in order to provide those persons with incentives to serve the Company.

REQUIRED VOTE

The affirmative vote of holders of a majority of the votes properly cast at the Annual Meeting is required to approve the Amendment to increase the number of shares of Common Stock issuable thereunder by 8,000,000 from 12,750,000 to 20,750,000, to extend the termination date of the 2014 Plan from May 24, 2027 to May 12, 2031, to provide required minimum vesting periods on equity-based Awards (as defined below), and to provide that dividends and dividend equivalents shall not be paid with respect to a stock option or stock appreciation right.

For the purpose of determining whether a majority of the votes have been cast in favor of the approval of the Amendment, only those cast “For” or “Against” are included, and any abstentions or broker non-votes will not count in making that determination. Additionally, NYSE rules require that at least a majority of the votes that all stockholders are entitled to cast at the Annual Meeting must vote on the Amendment, whether for or against. Because the NYSE requirement sets the higher standard, this item will not pass unless the number of votes meeting the NYSE voting requirements have been cast on this matter.

2014 PLAN

FACTORS FOR SHARE INCREASE

In approving the increase in the number of shares reserved for issuance under the 2014 Plan, the Board considered the following factors:

EQUITY RUN RATE

As of March 1, 2021, only 955,587 total shares remained available for grant under the Company’s equity plans, all of which are available under the 2014 Plan. As of March 1, 2021, there are no shares remaining available for grant under the Iron Mountain Incorporated 2002 Stock Incentive Plan. The Board currently believes that the proposed increase of 8,000,000 shares under the 2014 Plan should result in an adequate number of shares of Common Stock for future awards for approximately three (3) years, although this forecast includes several assumptions and there are a number of factors that could impact the Company’s future equity share usage. Among the factors that will impact the Company’s share usage are: changes in market grant values; changes in the number of recipients; changes in the Company’s stock price; payout levels of performance-based awards; changes in the structure of the Company’s long-term incentive programs; and forfeitures of outstanding awards.

Table of Contents

CORPORATE GOVERNANCE MATTERS

OVERHANG

If stockholders approve the increase in the reserve under the 2014 Plan, the total shares available for grant under all of the Company’s equity plans would be 8,955,587 and would represent approximately 3.1% of 288,704,904 shares of Common Stock outstanding as of March 1, 2021.

As of March 1, 2021, the Company had approximately 3,100,186 full value awards outstanding under all of its equity plans. In addition, as of March 1, 2021, the Company had approximately 5,065,733 stock options outstanding under all of its equity plans, which stock options had a weighted average exercise price of $35.83 and a weighted average remaining term of 6.35 years. If stockholders approve the Amendment, as of March 1, 2021, the potential overhang(1) from all stock awards granted and available to employees and directors would increase from 3.06% to 5.60%.

As a result of increasing the number of shares, it is also possible to extend the termination date of the 2014 Plan, which the Board believes is an appropriate action.

In addition, the Amendment will provide that equity-based awards generally shall not vest, in whole or in part, before the first anniversary of the date of grant or, in the case of vesting based upon the attainment of performance goals or other performance-based objectives, the first anniversary of the commencement of the period over which performance is evaluated. The Compensation Committee may make exceptions for accelerated vesting in connection with death, disability or retirement, awards of an acquired, consolidated or merged entity that are substituted for Awards (as defined below) that do not reduce the vesting period of the award being replaced, or for equity-based awards that result in the issuance of an aggregate of up to 5% of the shares available for grant under the 2014 Plan. In addition, unvested equity-based awards will also undergo accelerated vesting upon certain involuntary terminations in connection with a change in control (as discussed below). The Board believes that providing a 12-month minimum vesting period on all equity-based awards granted under the 2014 Plan is consistent with the principles of good corporate governance and will promote the interests of stockholders and is advisable. For these same reasons, the Amendment will also provide that dividends and dividend equivalents shall not be paid with respect to a stock option or stock appreciation right.

The closing price of the Company’s Common Stock on March 1, 2021 was $34.73.

SUMMARY OF THE 2014 PLAN

The following summary of the material features of the 2014 Plan is qualified in its entirety by reference to the complete text of the 2014 Plan, which is filed as an appendix to the Company’s Proxy Statements on Schedule 14A filed on December 23, 2014, as amended by the First Amendment to the Iron Mountain Incorporated 2014 Stock and Cash Incentive Plan, filed as Exhibit 10.1 to the Company’s Form 8-K, dated May 23, 2017, and the Second Amendment to the Iron Mountain Incorporated 2014 Stock and Cash Incentive Plan, filed as Exhibit 10.01 to the Company’s Form 10-Q for the quarter ended September 30, 2018.

The 2014 Plan permits the issuance of equity-based awards, including incentive stock options (“ISOs”), nonqualified stock options (“NSOs”), grants of Common Stock, whether or not subject to restrictions, stock appreciation rights (“SARs”), RSUs and PUs, that vest based on certain performance criteria, and cash-based awards that may be earned based on certain performance criteria (collectively, “Awards”). The 2014 Plan initially reserved 7,750,000 shares of Common Stock, which was subsequently increased to 12,750,000 by an amendment that was adopted by resolution of the Board on March 24, 2017. If stockholders approve the Amendment, the total amount of Common Stock authorized for issuance under the 2014 Plan will be 20,750,000.

EFFECTIVE DATE AND DURATION

The 2014 Plan became effective on January 20, 2015. The 2014 Plan currently provides for termination on May 24, 2027 or May 12, 2031 if the Amendment is adopted, unless earlier terminated by the Board. Termination of the 2014 Plan will not affect Awards made prior to termination, but no new Awards will be made after the 2014 Plan terminates.

PURPOSE AND ELIGIBILITY

The purpose of the 2014 Plan is to advance the interests of our stockholders by enhancing our ability to attract, retain and motivate persons who are expected to make important contributions to us and our affiliates, and to provide those persons with equity ownership opportunities and performance-based equity and cash compensation. For this purpose, any present or future parent or subsidiary corporation, and any other present or future business venture in which we have a controlling interest, may be treated as an affiliate of ours.

(1) | Overhang is calculated by dividing (1) the sum of (i) the number of shares of Common Stock subject to equity awards outstanding as of March 1, 2021 and (ii) the number of shares of Common Stock available for future grants, by (2) the sum of (x) number of shares of Common Stock outstanding as of March 1, 2021 and (y) equity awards outstanding and available for grant. |

32 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

The persons eligible to receive Awards are our and our affiliates’ employees, officers, directors, consultants and advisors and those of our affiliates. The recipient of an Award under the 2014 Plan is referred to below as a “Participant.” At this time, we consider approximately 1,500 persons eligible to receive Awards pursuant to the 2014 Plan.

ADMINISTRATION

Although our Board has the authority to administer the 2014 Plan, it has generally delegated this authority to the Compensation Committee, which administers all of our equity-based compensation plans. Each member of the Compensation Committee is a “non-employee director” within the meaning of Rule 16b-3 promulgated under the Exchange Act and qualifies as independent under NYSE listing standards.

Subject to the terms of the 2014 Plan, the Compensation Committee has the authority to: (1) select or approve Award recipients; (2) determine the terms and conditions of Awards, including the price to be paid for any Common Stock; and (3) interpret the 2014 Plan and prescribe rules and regulations for its administration.

Awards, at the discretion of the Compensation Committee, may be transferable to members of a Participant’s immediate family or to a family partnership or trust for the benefit of a Participant’s immediate family.

SHARES SUBJECT TO THE 2014 PLAN

The total number of shares of our Common Stock that may be subject to Awards under the 2014 Plan may not exceed 12,750,000 shares, or 20,750,000 shares if the Amendment is approved. The shares may be authorized but unissued shares or treasury shares. The total amount of Common Stock that may be granted under the 2014 Plan to any single person in any year may not exceed in the aggregate 1,250,000 shares. The aggregate economic value of all equity-based and equity-related Awards granted under the 2014 Plan in any year to any director who is not an employee of the Company shall not exceed $500,000, determined, for each Award, by using the Fair Market Value (as defined in 2014 Plan) as of the date such Award is granted. In the event a cash-based Award under the 2014 Plan is made, such Award shall not exceed $7,500,000 in any year to any single person.

To the extent that an option or other form of Award lapses or is forfeited, the shares subject to the Award will again become available for grant under the terms of the 2014 Plan.

As of March 1, 2021, 6,025,107 equity-based Awards were outstanding under the 2014 plan, consisting primarily of stock options, target PUs and RSUs.

STOCK OPTIONS

The Compensation Committee may grant ISOs and NSOs (each as defined in the 2014 Plan) under the 2014 Plan. The Compensation Committee determines the number of shares of Common Stock subject to each option, its exercise price, its duration and the manner and time of exercise; provided, however, that no option may be issued under the 2014 Plan with an exercise price that is less than the Fair Market Value of our Common Stock as of the date the option is granted, no option will have a duration that exceeds ten years, and, if the Amendment is approved, dividends and dividend equivalents shall not be paid with respect to an option. ISOs may be issued only to employees of the Company or a corporate subsidiary thereof and, in the case of a more than ten percent stockholder, must have an exercise price that is at least 110% of the Fair Market Value of our Common Stock as of the date the option is granted, and may not have a duration of more than five years.

The Compensation Committee, in its discretion, may provide that any option is subject to vesting limitations that make it exercisable during its entire duration or during any lesser period of time.

The exercise price of an option may be paid in cash, by delivery of a recourse promissory note secured by the Common Stock acquired upon exercise of the option (except that such a loan would not be available to any of our executive officers or directors), by means of a “cashless exercise” procedure in which a broker transmits to us the exercise price in cash, either as a margin loan or against the Participant’s notice of exercise and confirmation by us that we will issue and deliver to the broker stock certificates for that number of shares of Common Stock having an aggregate Fair Market Value equal to the exercise price, or agrees to pay the exercise price to us in cash upon our receipt of stock certificates, by delivery of shares of Common Stock owned by the Participant, by a “net exercise” in the case of an NSO or by any combination of the methods listed.

Table of Contents

CORPORATE GOVERNANCE MATTERS

Except in connection with a corporate transaction involving the Company, the terms of an option may not be amended to reduce the exercise price (or cancel the option for cash, other Awards or other options with an exercise price less than the exercise price of the existing option) without stockholder approval.

STOCK APPRECIATION RIGHTS

The Compensation Committee may also grant SARs to Participants on such terms and conditions as it may determine. SARs may be granted separately or in connection with an option. No SAR may be issued under the 2014 Plan with an exercise price that is less than the Fair Market Value of our Common Stock as of the date the SAR is granted, and no SAR will have a duration that exceeds ten years. If the Amendment is approved, dividends and dividend equivalents shall not be paid with respect to a SAR. Upon the exercise of a SAR, the Participant is entitled to receive payment equal to the excess of the Fair Market Value, on the date of exercise, of the number of shares of Common Stock for which the SAR is exercised over the exercise price for the Common Stock under a related option or, if there is not a related option, over an amount per share stated in the agreement setting forth the terms and conditions of the SAR.

Payment to the Participant may be made in cash or other property, including Common Stock, in accordance with the provisions of the SAR agreement.

Except in connection with a corporate transaction involving the Company, the terms of a SAR may not be amended to reduce the exercise price (or cancel a SAR for cash, other Awards or other SARs with an exercise price less than the exercise price of the existing SAR) without stockholder approval.

STOCK GRANTS

The Compensation Committee may make an Award in the form of one or more of the following forms of stock grant. Stock grants (including RSUs and PUs at settlement) generally will provide the Participant with all of the rights of a stockholder, including the right to vote and to receive payment of dividends.

STOCK GRANT WITHOUT RESTRICTION

The Compensation Committee may make a stock grant without any restrictions.

RESTRICTED STOCK AND RESTRICTED STOCK UNITS

The Compensation Committee may issue shares of Common Stock to a Participant with restrictions determined by the Compensation Committee in its discretion. Restrictions could include conditions that require the Participant to forfeit the shares in the event that the Participant ceases to provide services to us or any of our affiliates thereof before a stated time.

RSUs are similar to restricted stock except that no shares are actually issued to the Participant on the RSU grant date. Rather, and provided all applicable restrictions are satisfied, shares of Common Stock are generally delivered at settlement of the Award. The period of restriction, the number of shares of restricted stock or the number of RSUs granted, the purchase price, if any, and such other conditions and/or restrictions as the Compensation Committee may establish will be set forth in an Award agreement.

Participants holding RSUs will not have voting rights or other rights as a stockholder until any shares related to the RSU are issued. After all conditions and restrictions applicable to restricted shares and/or RSUs have been satisfied or have lapsed, shares of restricted stock will become freely transferable and RSUs may be settled in cash, in shares of our Common Stock, or in some combination of cash and shares of our Common Stock, as determined by the Compensation Committee and stated in the Award agreement.

PERFORMANCE SHARES AND PERFORMANCE UNITS

With respect to an Award of performance shares and/or PUs, the Compensation Committee will establish performance periods and performance goals. The extent to which a Participant achieves his or her performance goals during the applicable performance period will determine the value and/or the number of performance shares and/or PUs earned by such Participant. Payment of earned performance shares and/or PUs will be in cash, shares of our Common Stock, or some combination of cash and shares of our Common Stock, as determined by the Compensation Committee and stated in the Award agreement.

34 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

DIVIDENDS

Participants holding restricted stock and performance shares will be entitled to receive dividends on our shares, provided that in the discretion of the Compensation Committee Participants will not be entitled to dividends with respect to unvested restricted stock and performance shares until the stock or shares vest, respectively. Dividend equivalent units may, but are not required to, be issued with respect to RSUs or PUs and may be paid in cash, additional shares of our Common Stock, or a combination on the date the shares are delivered, all as determined by the Compensation Committee and stated in the Award agreement.

CASH-BASED AWARDS

The Compensation Committee may make a cash-based Award in an amount and upon such terms as the Compensation Committee may determine, based on the achievement of performance goals established by the Compensation Committee.

PERFORMANCE GOALS

Prior to the Tax Cuts and Jobs Act of 2017 (“TCJA”) eliminating the performance-based compensation exemption, if the Compensation Committee made an Award intended to qualify as “performance-based compensation” under Section 162(m) of the Code as then in effect (including a PU or a cash-based Award), the performance goals selected by the Compensation Committee needed to be based on the achievement of specified levels of one, or any combination, of the following business criteria, measured in the aggregate or on a per share basis (if appropriate): EBITDA (earnings before interest, taxes, depreciation and amortization); OIBDA (operating income before depreciation and amortization); adjusted OIBDA or Contribution (as defined in the 2014 Plan); gross revenues; storage rental revenue; growth rate; capital spending; capital efficiency; maintenance capital spending; free cash flow; funds from operations (as defined by the National Association of Real Estate Investment Trusts); funds from operations (normalized); adjusted funds from operations; building utilization; racking utilization; dividends; same store sales; same store net operating income; operating income (before or after taxes); net operating income; attaining budget; return on total or incremental invested capital; gross profit or margin; operating profit or margin; net earnings (before or after taxes); earnings per share; adjusted earnings per share; net income; share price (including but not limited to growth measures and total stockholder return); return on assets, return on equity, return on sales or return on revenue; other cash flow measures (including operating cash flow, cash flow return on equity, cash flow return on investment and free cash flow before acquisitions and discretionary investments); productivity ratios or metrics; market share; customer satisfaction; working capital targets; storage volume; organizational or transformational metrics; and achievement of stated corporate goals including, but not limited to acquisitions or dispositions, alliances, joint ventures, international development, and internal expansion. Although the 2014 Plan continues to provide the foregoing business criteria as possible performance-based metrics for an Award, the TCJA’s elimination of the performance-based compensation exemption under Section 162(m) of the Code may cause certain of our compensation arrangements to result in non-deductible compensation when the total exceeds $1,000,000 (other than certain historical awards that meet transition rules for continued deductibility under the TCJA).

Any such criteria, whether alone or in combination, may be applied on the basis of our and/or our affiliates as a whole or on any business unit or subset of us and/or an affiliate of ours and may be measured directly, as a growth rate or by comparing the result to the performance of a group of competitor companies, a published or special index determined by the Compensation Committee or other benchmarks determined by the Compensation Committee. The objectives shall be further adjusted by the Compensation Committee as necessary to eliminate the effect on the stated performance goals of unplanned acquisitions or dispositions, changes in foreign exchange rates, discrete tax items identified by the Compensation Committee, changes in accounting standards, variances to planned annual incentive compensation expense and expenses associated with unusual or extraordinary items that could not be reasonably anticipated, as long as those items or changes are material to the performance measure.

After the close of the applicable performance period, which may consist of more than one year, and generally before the close of the next year’s first quarter, the Compensation Committee will determine the extent to which the performance goals were satisfied and make a final determination with respect to an Award.

In the event that applicable tax laws change to permit Compensation Committee discretion to alter the performance goals without obtaining stockholder approval, the Compensation Committee will have sole discretion to make any such alterations.

EFFECT OF CERTAIN CORPORATE TRANSACTIONS

In the event of a stock split, reverse stock split, stock dividend, recapitalization, combination of shares, reclassification of shares, spin-off or other similar change in capitalization or event, or any dividend or distribution on our Common Stock other than an ordinary cash dividend, the Compensation Committee shall make equitable adjustments to Awards as it, in its sole discretion, deems appropriate. In the case of (1) a merger or consolidation of the Company with or into another entity pursuant to which all of our Common Stock is cancelled or converted into or exchanged for the right to receive cash, securities or other property, (2) any transfer or disposition of all of our Common Stock for

Table of Contents

CORPORATE GOVERNANCE MATTERS

cash, securities or other property pursuant to a share exchange or other transaction, (3) the sale or other disposition of all or substantially all of the Company’s assets, or (4) any liquidation or dissolution of the Company, the Compensation Committee may take any of a number of actions including providing for the assumption of Awards, the termination of Awards (with advance notice permitting exercise), Awards to become exercisable at or prior to the event, the liquidation of Awards or any combination of the foregoing.

The 2014 Plan also provides that any unvested Awards will generally vest immediately should a Participant be terminated by us or our successor (or should the Participant terminate for “good reason”) in connection with a “vesting change in control” within 14 days prior or 12 months after the vesting change in control.

A vesting change of control is generally defined to include, among other things: (1) a sale of us or substantially all of our assets; (2) the acquisition by a person or group of securities representing 50% or more of the voting power of the Company’s securities entitled to vote in the election of directors; or (3) certain changes in the composition of our board of directors over a period of time that are not approved by our board of directors. “Good reason” for this purpose is generally defined to include: (i) a diminution in the total annual compensation or material diminution in benefits the Participant is eligible to receive; or (ii) a requirement by us that the Participant be based at an office that is greater than 50 miles from the location of the Participant’s office immediately prior to the vesting change in control.

AMENDMENTS TO THE 2014 PLAN

Our Board may amend, suspend or terminate the 2014 Plan in whole or in part at any time provided that stockholder approval shall be required to the extent necessary under the rules applicable to ISOs or under NYSE or other applicable securities exchange rules.

The Compensation Committee may, without stockholder approval, amend the 2014 Plan as necessary to enable Awards to qualify for favorable foreign tax, securities or other treatment in the case of a Participant who is subject to a jurisdiction outside the United States.

TAX TREATMENT

The following description of the federal income tax consequences of Awards is general, does not purport to be complete, and does not describe state, local or foreign tax consequences.

TAX TREATMENT OF NONQUALIFIED STOCK OPTIONS

A Participant realizes no taxable income when an NSO is granted. Instead, the difference between the Fair Market Value of the Common Stock acquired pursuant to the exercise of the option and the exercise price paid is taxed as ordinary compensation income when the option is exercised. The difference is measured and taxed as of the date of exercise, if the Common Stock is not subject to a “substantial risk of forfeiture,” or as of the date or dates on which the risk terminates in other cases. A Participant may elect to be taxed on the difference between the exercise price and the Fair Market Value of the Common Stock on the date of exercise, even though some or all of the Common Stock acquired is subject to a substantial risk of forfeiture. Once ordinary compensation income is recognized, gain on the subsequent sale of the Common Stock is taxed as short-term or long-term capital gain, depending on the holding period after exercise. We receive no tax deduction on the grant of a nonqualified stock option, but we are entitled to a tax deduction when a Participant recognizes ordinary compensation income on or after exercise of the option, in the same amount as the income recognized by the Participant.

TAX TREATMENT OF INCENTIVE STOCK OPTIONS

Generally, a Participant incurs no federal income tax liability on either the grant or the exercise of an ISO, although a Participant will generally have taxable income for alternative minimum tax purposes at the time of exercise equal to the excess of the Fair Market Value of the Common Stock subject to the option over the exercise price. Provided that the Common Stock is held for at least one year after the date of exercise of the option and at least two years after its date of grant, any gain realized on a subsequent sale of the Common Stock will be taxed as long-term capital gain. If the Common Stock is disposed of within a shorter period of time, the Participant will recognize ordinary compensation income in an amount equal to the difference between the Fair Market Value of the stock on the date of exercise (or the sale price of the shares sold, if less) over the exercise price. We receive no tax deduction on the grant or exercise of an ISO, but we are entitled to a tax deduction if the Participant recognizes ordinary compensation income on account of a premature disposition of shares acquired on exercise of an ISO, in the same amount and at the same time as the Participant recognizes income.

36 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

TAX TREATMENT OF STOCK APPRECIATION RIGHTS

A Participant realizes no income upon the grant of an SAR, but upon its exercise recognizes ordinary compensation income in an amount equal to the cash or cash equivalent received at that time. If the Participant receives Common Stock upon exercise of an SAR, he or she recognizes ordinary compensation income equal to the Fair Market Value of the Common Stock received (reduced, if applicable, by the base amount set forth in the related agreement), assuming the Common Stock is not subject to a substantial risk of forfeiture at exercise. We are entitled to a tax deduction in the amount of ordinary compensation income recognized.

TREATMENT OF STOCK GRANTS

A person who receives an Award of Common Stock without any restrictions will recognize ordinary compensation income equal to the Fair Market Value of the Common Stock over the amount (if any) paid. If the Common Stock is subject to restrictions, the recipient generally will not recognize ordinary compensation income at the time the Award is received but will recognize ordinary compensation income when restrictions constituting a substantial risk of forfeiture lapse. The amount of that income will be equal to the excess of the aggregate Fair Market Value, as of the date the restrictions lapse, over the amount (if any) paid for the Common Stock. Alternatively, a Participant may elect to be taxed, pursuant to Section 83(b) of the Code, on the excess of the Fair Market Value of the Common Stock at the time of grant over the amount (if any) paid for the Common Stock, notwithstanding any restrictions. All such taxable amounts are deductible by us at the time and in the amount of the ordinary compensation income recognized by the Participant.

A Participant who receives RSUs or PUs generally will not recognize ordinary compensation income at the time of grant. Rather, the Participant will generally recognize ordinary compensation income equal to the Fair Market Value of the Common Stock or cash received less the price paid, if any, at the time the RSU or PU settles shortly after vesting. When any Common Stock received is subsequently sold, the Participant generally will recognize capital gain or loss equal to the difference between the amount realized upon the sale of the shares and his or her tax basis in the shares (generally, the Fair Market Value of the stock when acquired plus any amount paid). The capital gain or loss will be long-term if the stock was held for more than one year or short-term if held for a shorter period. The Company will be entitled to a tax deduction when the Participant recognizes ordinary compensation income.

DIVIDENDS

The full amount of dividends or other distributions of property made with respect to stock grants before the lapse of any applicable restrictions will constitute ordinary compensation income, and the Company is entitled to a deduction at the same time and in the same amount as the income is realized by the Participant (unless an election under Section 83(b) of the Internal Revenue Code has been made). Dividend equivalents on RSUs and PUs will be taxed as additional ordinary compensation income at settlement, and we will be entitled to a deduction at the same time and in the same amount.

SECTION 162(M) OF THE CODE

Section 162(m) of the Code generally disallows an income tax deduction to public companies for compensation in excess of $1,000,000 paid in any year to the principal executive officer, the principal financial officer and the three other most highly compensated executive officers. In addition, each person covered by Section 162(m) of the Code for a particular year after 2016 remains subject to the $1,000,000-limit in subsequent years, even if not included in that group for the year. As noted above, TCJA eliminated after 2017 the performance-based compensation exemption. As a result, it is expected that certain of our compensation arrangements will result in non-deductible compensation when the total exceeds $1,000,000, except certain historical awards that meet transition rules for continued deductibility under the TCJA. Nevertheless, the deductibility of compensation is but one of the critical factors in the design and implementation of any compensation arrangement, and the Compensation Committee and our Board reserve the right to pay nondeductible compensation when appropriate.

AWARD INFORMATION

The benefits or amounts that may be received or allocated to any individual under the 2014 Plan are not determinable, other than amounts that may be received by each non-employee director under Iron Mountain’s existing Compensation Plan for Non-Employee Directors, which provides for an annual stock grant of that number of whole shares of Iron Mountain Common Stock determined by dividing $160,000 by the stock’s Fair Market Value on the date of grant, in addition to various cash retainers.

Table of Contents

CORPORATE GOVERNANCE MATTERS

PROPOSAL

3

APPROVAL OF AN AMENDMENT TO THE 2013 ESPPThe Board recommends that you vote FOR the approval of an amendment to the 2013 ESPP, to increase the number of shares of Common Stock authorized for issuance thereunder by 1,000,000.

|

The Board has unanimously approved, and unanimously recommends that the stockholders of the Company approve, an amendment, attached hereto as Appendix B (the “ESPP Amendment”), to increase the number of shares of Common Stock authorized for issuance under the 2013 ESPP by 1,000,000 from 1,000,000 to 2,000,000. The purpose of the 2013 ESPP is to provide employees of the Company and its participating subsidiaries the opportunity to acquire an equity interest in the Company by providing favorable terms for them to purchase the Company’s Common Stock. The 2013 ESPP also includes provisions that permit the adoption of one or more subplans that may not satisfy the requirements of Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”), but are designed to facilitate use of the 2013 ESPP outside the U.S. (a “2013 ESPP Subplan”).

The Board believes that equity-based compensation is a significant factor in the Company’s ability to attract, retain and motivate its employees, who are critical to the Company’s long-term success, and that an increase in the number of shares available for issuance under the 2013 ESPP will further the goal of providing employees with incentives to serve the Company.

As of March 1, 2021, only 216,287 total shares of Common Stock remained authorized for issuance under the 2013 ESPP. Unless the ESPP Amendment is approved, we do not believe that there will be enough authorized shares of Common Stock under the 2013 ESPP for regular, anticipated issuances for offering periods beginning after 2021 (based on past experience with the 2013 ESPP). The Board currently believes that the proposed increase of 1,000,000 shares of Common Stock authorized for issuance under the 2013 ESPP should result in an adequate number of shares of Common Stock for future issuance for approximately 7 years, although this forecast includes several assumptions and there are a number of factors that could impact the Company’s future Common Stock issuances. We are asking stockholders to approve the ESPP Amendment. Apart from the ESPP Amendment, no other terms or conditions of the 2013 ESPP will change.

On March 1, 2021, the closing price per share of the Company’s Common Stock, as listed on the NYSE, was $34.73.

REQUIRED VOTE

The affirmative vote of holders of a majority of the votes properly cast at the Annual Meeting is required to approve the ESPP Amendment to increase the number of shares of Common Stock issuable under the 2013 ESPP by 1,000,000 from 1,000,000 to 2,000,000. For purposes of determining whether a majority of the votes has been cast in favor of the approval of the ESPP Amendment, only those cast “For” or “Against” are included, and any abstentions or broker non-votes will not count in making that determination.

2013 ESPP

SUMMARY OF THE 2013 ESPP

The following summary of the material features of the 2013 ESPP is qualified in its entirety by reference to the complete text of the 2013 ESPP, attached as Appendix A to the Company’s Proxy Statement on Schedule 14A filed on April 24, 2013. The summary of the 2013 ESPP set forth below assumes the approval of the ESPP Amendment and is qualified in its entirety by reference to the 2013 ESPP as proposed to be amended. As noted above, other than the change to the 2013 ESPP proposed to be made by the ESPP Amendment, no other terms or conditions of the 2013 ESPP will change.

OVERVIEW

The 2013 ESPP operates by granting, in a series of offerings, options to acquire the Company’s Common Stock. The Compensation Committee, which has been delegated authority to administer the 2013 ESPP by the Board, determines the commencement date and duration of offerings. The Compensation Committee may also limit the maximum amount of Common Stock available with respect to an offering.

38 |  |

Table of Contents

CORPORATE GOVERNANCE MATTERS

Offerings under the 2013 ESPP generally last for six months and begin each June 1 and December 1 (or the preceding business day). During an offering, payroll deductions are accumulated on behalf of each participant. At the end of each offering, options issued under the 2013 ESPP are exercised and the accumulated payroll deductions are retained by the Company as full payment of the option price. Each participant receives a number of whole shares of the Company’s Common Stock equal to the accumulated payroll deductions credited to the participant’s account as of the exercise date divided by the option price. In general and except in the case of cash in lieu of a fractional share, any excess cash remaining at the close of an offering is not carried over to the next offering and is instead returned to a participant, without earnings.

The “option price” of shares of Common Stock under the 2013 ESPP can be as low as 85% of the lower of the fair market value of the Company’s shares at the start of the offering or on the exercise date. However, the 2013 ESPP utilizes an option price of 95% of the fair market value of the Company’s shares on the exercise date. Fair market value under the 2013 ESPP generally means the average of the highest and lowest sale price of the Company’s Common Stock on the date in question.

The Compensation Committee may adopt one or more 2013 ESPP Subplan(s) in order to facilitate participation by employees in countries that have local laws that may be inconsistent with Section 423 of the Code. In general, however, the key terms and conditions of any such 2013 ESPP Subplan will reflect the same terms and conditions of the 2013 ESPP as offered to eligible U.S. employees to the extent possible.

SHARES AVAILABLE UNDER THE 2013 ESPP

After giving effect to the ESPP Amendment, the total number of authorized shares that may be subject to options under the 2013 ESPP is 2,000,000. After giving effect to the ESPP Amendment, we project that there will be enough shares to keep the 2013 ESPP in place through 2028. The Compensation Committee may impose a cap on the amount of Common Stock available with respect to any offering, and has historically done so under the 2013 ESPP.

If an option expires or is terminated or surrendered, the shares allocable to the option may again be available under the 2013 ESPP. If insufficient shares are available at the end of an offering, a pro rata allocation of remaining shares will be made.

We intend to register the new shares reserved for issuance under the 2013 ESPP on a Registration Statement on Form S-8 under the Securities Act of 1933, as amended, as soon as practicable after receiving stockholder approval.

ELIGIBILITY AND PARTICIPATION

In general, any employee of the Company or a participating subsidiary that is (or is treated for federal income tax purposes as) a corporation who is customarily employed for more than five months in a calendar year and has performed services for the Company or a participating subsidiary for at least six months may become a participant in any future offering under the 2013 ESPP by electing to participate prior to the commencement of the offering. However, the following persons are ineligible to participate in the 2013 ESPP: (1) any employee who owns, directly or indirectly, as of the start of an offering, 5% or more of the Company’s stock or the stock of one of the Company’s corporate subsidiaries; (2) any employee of a subsidiary that is either ineligible to or does not elect to participate in the 2013 ESPP; (3) any union employee, if the union elects not to participate in the 2013 ESPP; and (4) any individual who is not an employee, including outside directors, consultants, and independent contractors. In addition, an employee will not be granted an option that would permit him or her to own (or be considered to own) or hold outstanding options to purchase 5% or more of the total combined voting power or value of all classes of the Company’s stock or that of a corporate subsidiary, and a participant cannot acquire in any year more than $25,000 worth of the Company’s stock under the 2013 ESPP (based on the value of the Company’s stock at the start of the offering). At this time, approximately 9,000 persons are considered by the Company to be eligible to receive options pursuant to the 2013 ESPP.

A participant may authorize payroll deductions of 1-15% of the participant’s cash compensation on each pay date. A participant can decrease his or her rate of payroll deductions, but the participant can never increase the rate of payroll deductions once an offering begins.